Peer Review Process

Peer Review Process

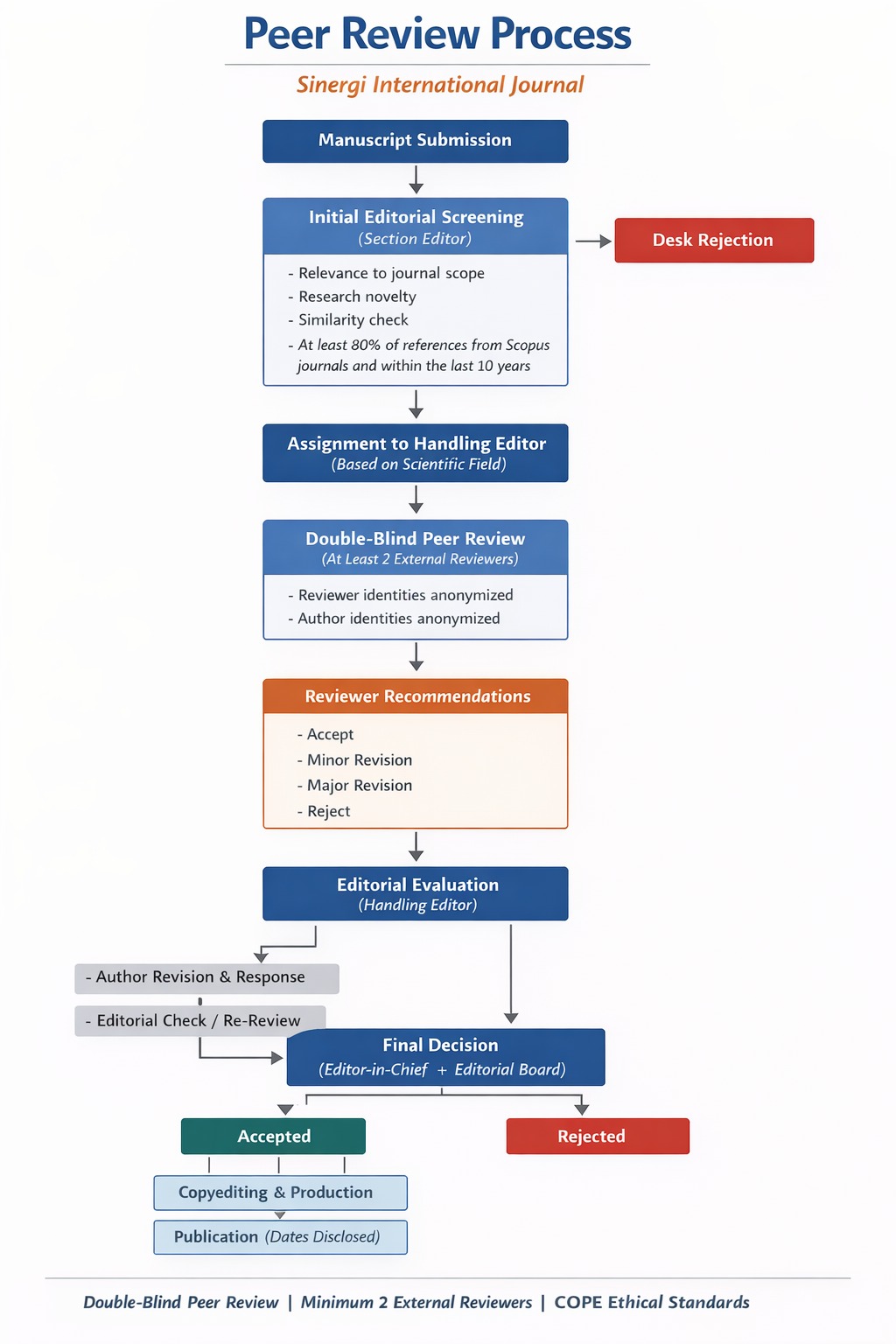

The Sinergi International Journal of Accounting and Taxation employs a stringent evaluation and assessment process for all submitted manuscripts. This process aims to ensure that published works meet high standards of academic quality and originality. We utilize a double-blind peer review system, which maintains anonymity between authors and reviewers throughout the evaluation process.

Our editorial team and reviewers comprise experts in accounting and taxation from diverse international backgrounds. This global perspective enhances the depth and breadth of manuscript assessments, leading to more comprehensive editorial decisions.

The review process unfolds as follows:

- Preliminary Evaluation: The Editor-in-Chief will screen a submitted manuscript to ensure its conformity to the Sinergi International Journal of Accounting and Taxation scope and basic submission requirements. The Editor-in-chief will assign an editor based on the articles’ scientific field.

- External Expert Assessment: Manuscripts passing the initial screening are assigned to a handling editor. This editor then forwards the manuscript to a minimum of two subject matter experts for double-blind peer review.

- Decision Based on Collective Input: The journal requires at least two expert reviews before making any decisions. In cases of significant discrepancies between reviews, a third reviewer may be engaged to provide additional insights. At this juncture, several outcomes are possible:

- Rejection of the manuscript

- Request for minor revisions

- Request for major revisions

- Acceptance without changes

- Recommendation for resubmission (if substantial content or language modifications are necessary)

Accepted manuscripts are returned to authors for formatting adjustments. The Editor-in-Chief makes the final acceptance decision, considering recommendations from the handling editor and with approval from the editorial board.

- Internal Revision Phase: Authors of manuscripts requiring revisions have a three-week window to modify and reformat their work. The handling editor then reassesses the revised manuscript, determining whether the changes adequately address reviewers' comments and suggestions. If revisions are deemed insufficient, this process may be repeated.

- Final Verdict: In this stage, the revised manuscript faces a binary outcome: acceptance or rejection. The decision hinges on the handling editor's assessment of whether the manuscript has been improved to meet the journal's publication standards. Manuscripts failing to incorporate necessary changes or falling short of the Sinergi International Journal of Accounting and Taxation's quality benchmarks will be rejected.